Sinology: China After COVID

By Andy Rothman

With the coronavirus largely under control in China, we have an opportunity to consider what the post-COVID investment environment there might look like. The Chinese economy won't fully recover until a safe and effective vaccine is widely available, but China is likely to remain the driver of global growth and the world's best consumer story in 2021. The results of the U.S. presidential election will present further political challenges for Beijing, but those tensions are unlikely to slow an economy which is driven primarily by domestic demand. We discuss three, post-election scenarios.

COVID largely under control…

China's run of 57 days without a single, locally transmitted COVID-19 case ended on October 11, when six cases were identified in the eastern city of Qingdao. These individuals were reportedly infected at a hospital which was treating patients who had arrived from abroad with the coronavirus. Another six cases were quickly identified, linked to the same hospital.

This incident highlights two aspects of the COVID problem. First, the disease will be very difficult to eradicate until a vaccine is in widespread use. Second, aggressive measures are needed to prevent small hotspots from quickly expanding into community-wide outbreaks.

Public health authorities in Qingdao immediately launched an effort to test everyone in the city, and within five days had conducted about 11 million tests—none of which came back positive for the virus. (As reference points, New York City has a population of about 8 million. Across the entire U.S., during the first 12 days of October, on average, just under one million COVID tests were conducted daily.)

On October 18, there were only 249 COVID patients in Chinese hospitals, down from 58,016 on the February 17 peak.

Since the pandemic began, the U.S., which has approximately 4% of the world's population, has recorded 21% of the world's COVID deaths. China, home to approximately 18% of the world's population, has recorded 0.4% of COVID deaths.

To be sure, some of the methods used by the Chinese government to successfully combat COVID would be difficult to deploy in a democracy. But other democracies have had greater success than the U.S. in controlling COVID. While the U.S. has recorded 67.2 deaths per 100,000 population, the death rate in Canada is 25.6. The death rates per 100,000 population are just under 12 in Germany and Denmark, and are below 1 in South Korea, New Zealand and Singapore.

…Allowing the economy to bounce back

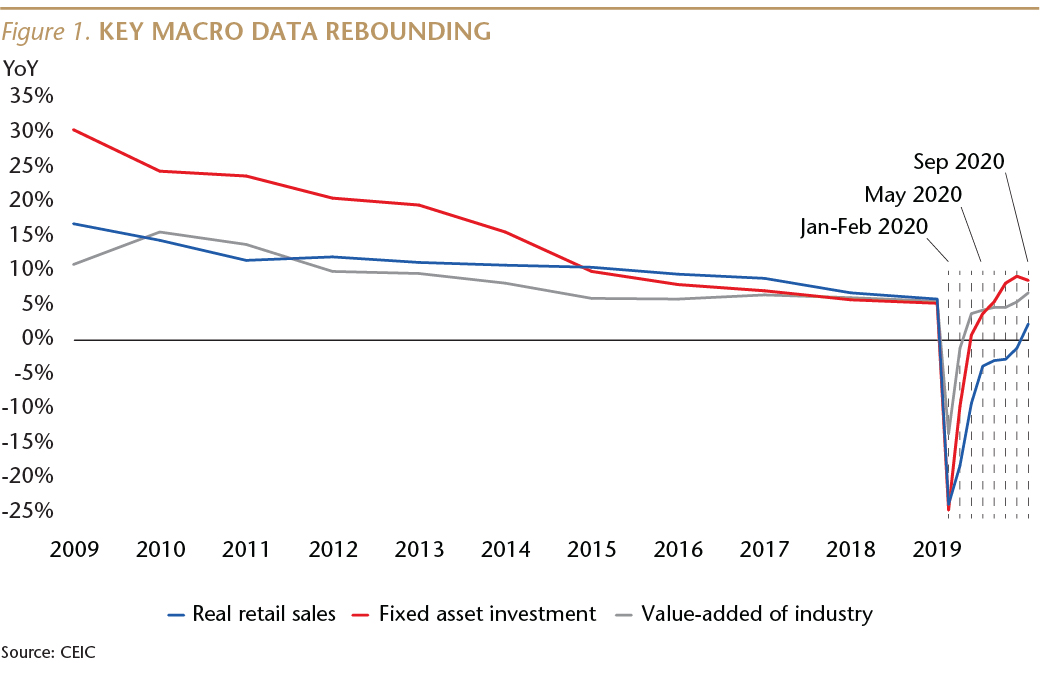

With COVID largely under control, life in China has been gradually getting back to normal since March, and September was the seventh consecutive month of a V-shaped economic recovery.

Regular readers of Sinology know that we rarely discuss GDP growth rates, as the other macro data outlined in this report is easier to verify and more useful for investors. But, for the record, China reported a third quarter real (inflation-adjusted) GDP growth rate of 4.9% year-on-year. That's down from the 6% pace in the third quarter of last year, but a dramatic improvement from the decline of 6.8% in 1Q20, when economy was in COVID lockdown. Last week, in an update to its World Economic Outlook, the IMF forecast that China will be the only major economy to grow on a YoY basis in 2020, and the Fund forecasts 8.2% YoY GDP growth for China next year. In my view, the IMF's China forecast growth rate for next year is too high, but I agree with the overall trend.

China's economy is increasingly driven by domestic demand, so it is important that consumer spending has been bouncing back. Last year was the eighth consecutive year in which the consumer and services (or tertiary) part of China's GDP was the largest part. Although consumer spending is likely to remain softer than usual until next year, on a relative basis China is likely to remain the world's best consumer story.

Traffic jams and long lines outside of popular restaurants are back in China. Auto sales have posted double-digit YoY growth for five consecutive months, and online sales of goods rose at a double-digit YoY pace in each of the last seven months. (3Q vehicle deliveries by GM and its joint ventures in China rose 12% YoY, including a 28% increase for Cadillac.) New home sales have registered YoY growth, in volume terms, for five straight months, after declining by 39% YoY during the first two months of the year. Industrial production has fully recovered.

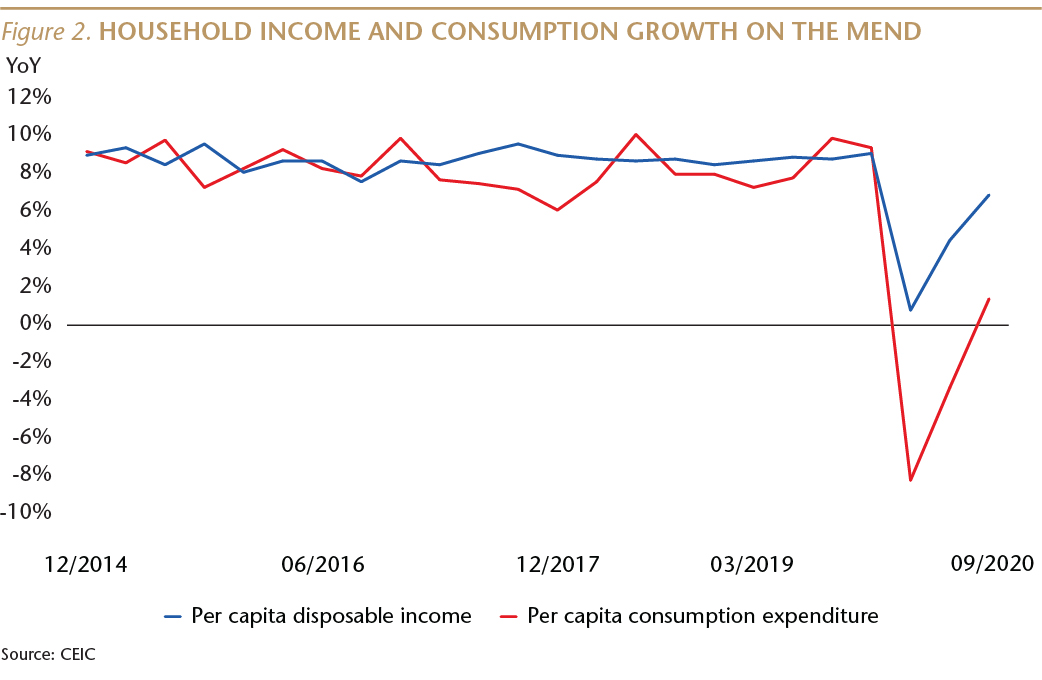

While the consumer story has been bouncing back, it has not fully recovered, as fears of catching the virus have depressed spending beyond the impact of slower income growth. Per capita disposable income rose 6.9% YoY in the third quarter, a big improvement from the 0.8% pace in 1Q20, but still weak compared to 8.8% a year ago. Per capita consumption expenditure rose 1.4% YoY in the third quarter, much better than the 1Q20 decline of 8.2% but off from a rise of 9.9% a year ago.

Travel and tourism is one sector that continues to be depressed by coronavirus concerns. During this month's eight-day national holiday, domestic trips were down 21% compared to last year's holiday. On the other hand, that was an improvement on April Dragon Boat holiday, when trips were down 61%.

COVID grounded overseas travel, to the benefit of domestic destinations. The tropical island of Hainan recorded a 9.3% YoY rise in tourist arrivals during the national day holidays, a sharp contrast to the 97.6% YoY decline in August visitor arrivals reported by the state of Hawaii.

It is likely that this part of the economy, as well as other businesses that require customers to gather in confined spaces, will take a long time to fully recover. This is why I expect China's economic activity to return to about 80% of normal by the end of this year, with the final 20% of the recovery unlikely until after the development and widespread use of a safe and effective vaccine.

Three scenarios for U.S. – China relations

The results of the upcoming U.S. presidential election will have a significant impact on U.S – China relations, and I'd like to present three scenarios.

Trump/back to January. The first scenario has President Trump win a second term, and restore the bilateral relationship to where it was pre-COVID: less confrontational and more transactional, focused on jobs and trade. This may sound unlikely given the current tensions, but consider that in January, before the pandemic, the president said U.S. – China relations had “never, ever been better,” and that he and Xi Jinping “love each other.” Since that time, Trump has criticized China for mishandling COVID, but he has not used the more inflammatory rhetoric of his secretary of state and attorney general. The president has also refrained from mocking Xi on Twitter. Trump may interpret a win in November as validation of his handling of COVID, eliminating the need to continue taking a confrontational approach toward Beijing, and returning his focus to his trade deal with Xi. If the president is re-elected, I assign this a 60% probability.

Trump/more confrontation. The second scenario has Trump win, and continue with the more aggressive, confrontational approach that his administration has pursued in recent months. This would include more trade and technology sanctions, as well as efforts to delist Chinese companies from American exchanges. This scenario would have the president's team continue to cast China as an enemy of the U.S., probably resulting in Xi's team deciding to start behaving like an enemy. This presumes that although Trump has not directly endorsed his team's characterization of China as an existential threat to the U.S., he approves of it. If Trump wins, I assign this a 40% probability.

Biden/incentivizing better behavior. The third scenario is if former Vice President Biden wins the election. I expect his approach to China would be based on two concepts: working with other democracies to collaborate with Beijing where possible, and to jointly apply pressure when necessary; and to incentivize Beijing to change its behavior, rather than rely on tariffs and delistings. Over the last 40 years, this kind of engagement with the Chinese government has significantly advanced a broad range of U.S. interests.

Political tensions shouldn't disrupt economic recovery

Three final points. First, if U.S.-China political relations become increasingly tense after the election, this should have a modest impact on the Chinese economy, which is fueled primarily by domestic demand.

Last year, domestic consumption accounted for almost 60% of China's GDP growth. The gross value of exports was equal to 17% of China's GDP (down from 35% in 2007), but almost 30% of those exports were processed goods for which little value was added in China. Significantly, over the last five years, net exports (the value of a country's exports minus its imports) have, on average, contributed zero to China's GDP growth. Moreover, only 17% of China's exports went to the U.S. last year.

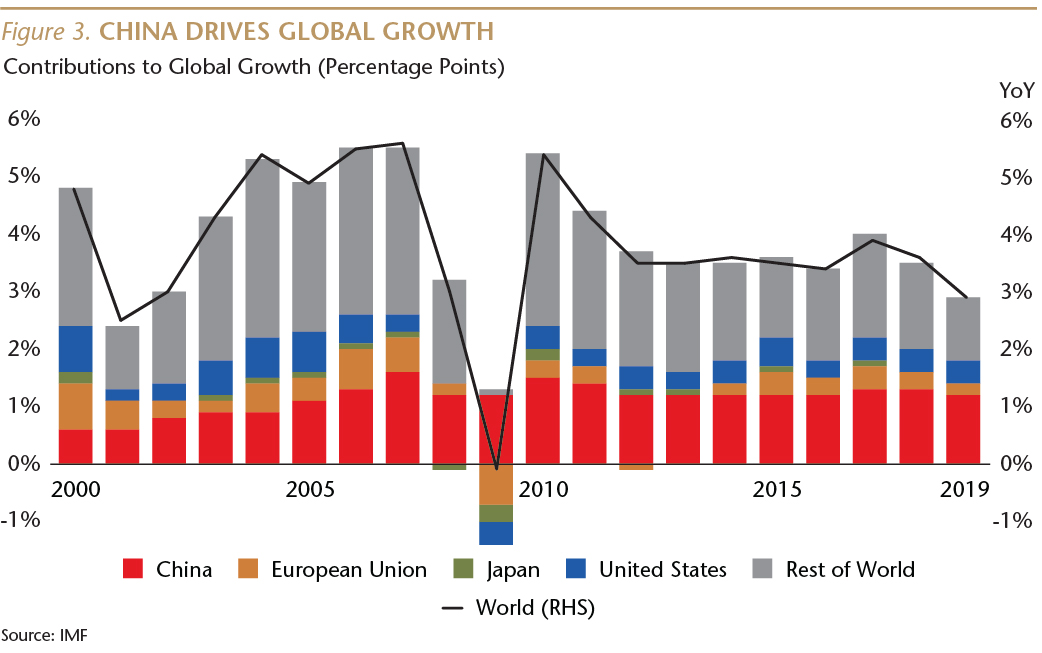

And despite the “trade war,” China's share of global exports reached a record high this year, and China continues to drive global economic growth.

Second, an investment strategy focused on the domestic demand story—Chinese companies selling goods and services to Chinese consumers—should also remain well insulated from bilateral political tensions.

Third, we should recognize that it is not possible to decouple from China's economy, which last year accounted for about 40% of global economic growth, larger than the combined share of global growth from the U.S., Europe and Japan. Moreover, it will be very difficult for the U.S. to address global issues like climate change, nuclear proliferation and drug trafficking without cooperation from the Chinese government.

Andy Rothman

Investment Strategist

Matthews Asia

As of September 30, 2020, accounts managed by Matthews Asia did not hold positions in General Motors Company.

Back to Thought Leadership