Sinology: Coronavirus Q&A

By Andy Rothman

I've been fielding many questions from investors about the new coronavirus, COVID-19, and would like to share my answers with you in this issue of Sinology.

I want to caveat my remarks with the caution that knowledge of this new disease is incomplete and evolving, so I will continue to monitor the scientific literature on a daily basis.

Before we get to the Q&A, all of us at Matthews Asia would like to express our sympathy for everyone affected by the virus.

What does the latest coronavirus data tell us?

At this time, data for the number of cases and fatalities due to the coronavirus, now officially referred to as COVID-19, reflects several promising trends. [All data in this report are as of February 23, 2020.]

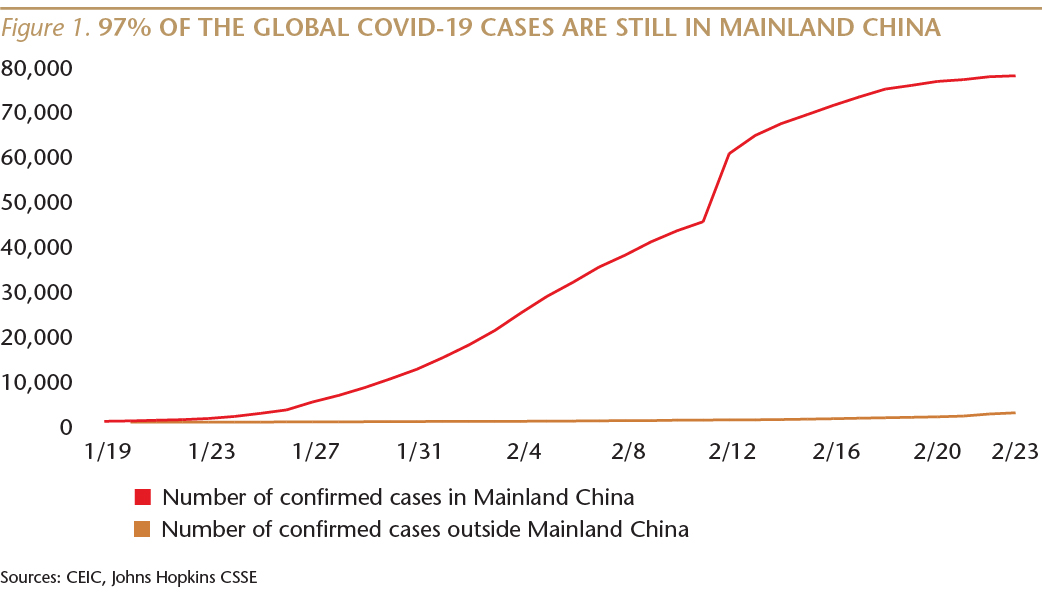

I think it is significant that 97% of global cases of COVID-19 are still within mainland China, despite the virus having been around since at least December. [The disease COVID-19, which is an abbreviation for “coronavirus disease 2019,” is caused by a virus which has been named “SARS-CoV-2.”]

The virus first appeared in the city of Wuhan, the capital of Hubei province, and 81% of the global cases are still in that province, up from 66% 20 days earlier. Hubei remains a public health disaster, which is important, as the province has a population roughly equal to that of of New York and California states combined. But the virus seems to be coming under control in the rest of China. In Shanghai, for example, the number of cases has risen to 335 today, up significantly from 208 cases 20 days ago, although a modest number for a city of 24 million people. The picture is similar in Beijing, which has a population of 22 million: 399 cases, up from 228 cases 20 days ago.

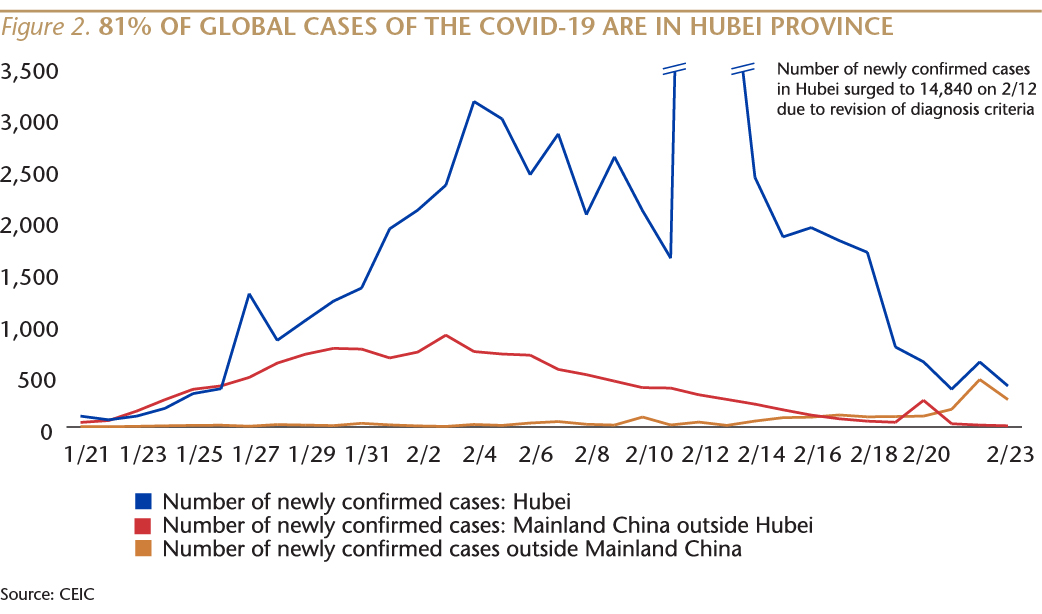

Note that Figure 2 shows a sharp spike in the number of newly confirmed cases in Hubei on February 12. That was the result of a decision by the Chinese government to begin using a broader definition of confirmed cases with the use of chest CT scans of people who displayed symptoms associated with COVID-19, such as coughing and difficulty breathing—even if those people had not been evaluated with more sensitive tests, or had tested negative for the virus. That spike in the number of new cases reflected a recognition that the Hubei health care system was overwhelmed, including a shortage of reliable test kits, and a desire to over- rather than undercount possible cases so that suspected patients could be isolated. That did not reflect a resurgence of the virus or a deliberate cover-up of past cases.

Figure 2 also shows that on February 19, the Chinese government resumed using a more traditional approach of only counting cases as “confirmed” based on positive results of the more sensitive laboratory tests. This decision, which resulted in 279 cases being removed from the “confirmed” count, was based on improved access to lab testing in Hubei.

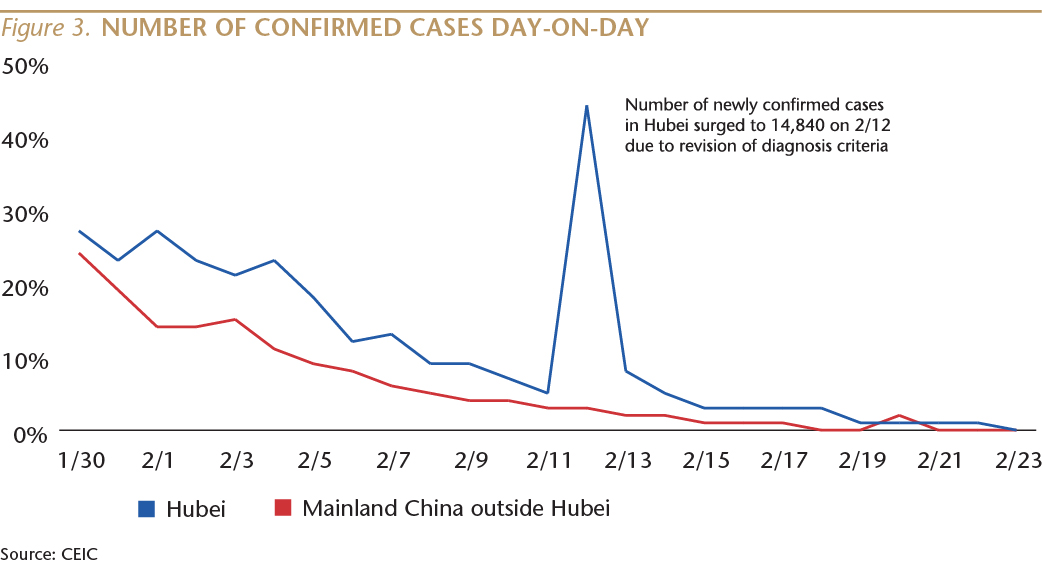

On February 23, there were only 11 new confirmed cases in mainland China ex-Hubei (down from 890 new confirmed cases on February 3, the peak), and that number had been falling in 19 of the past 20 days. None of the provinces aside from Hubei reported more than 10 new cases on the 23rd, the third day in a row. On the 23rd, the highest number of new cases for a province excluding Hubei was three in Guangdong, and 24 of the 31 provinces reported zero new cases. Unfortunately, Hubei reported 398 new cases that day: a declining but still large number. It will take a long time for Hubei to return to normal, but the rest of China seems to be moving in the right direction.

In a February 24 press conference, the director of the World Health Organization said, “the COVID-19 epidemic peaked and plateaued between the 23rd of January and the second of February and has been declining steadily since then.”

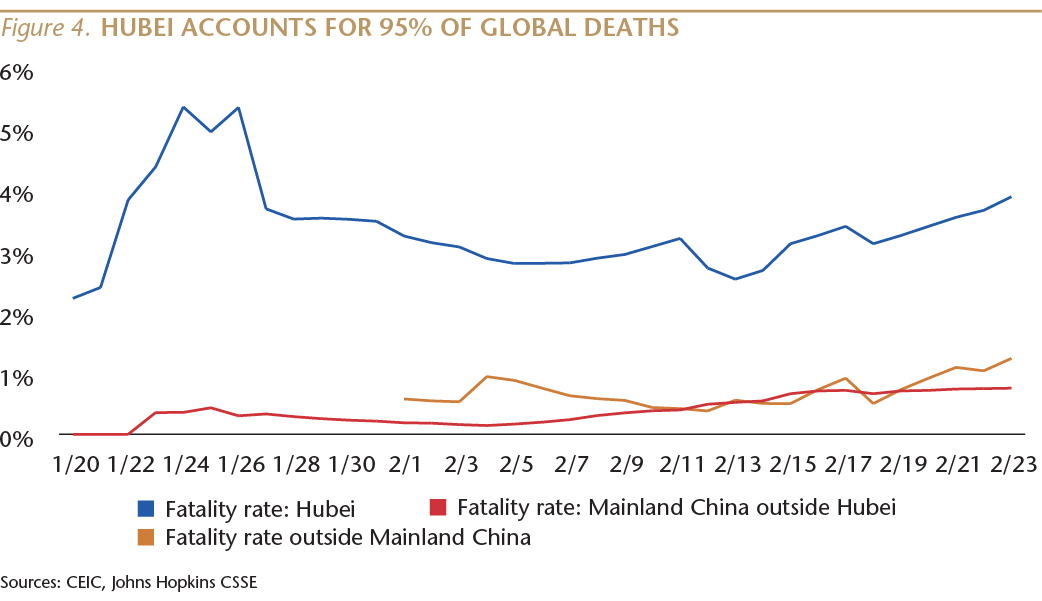

Deaths due to COVID-19 are also highly concentrated in Hubei province, where 95% of all global fatalities have taken place. There have been 26 deaths outside of mainland China (eight in Iran; six in South Korea; three in Italy; three aboard the Diamond Princess cruise ship; two in Hong Kong; and one each in France, Japan, the Philippines and Taiwan.)

The fatality rate is also far higher in Hubei (2-4% of cases) than in the rest of China (0.7%). For example, in Sichuan province, with a population of 83 million, there have been three fatalities. Shandong province, population 100 million, had four deaths as of February 23. Tragically, the Hubei health care system is so overwhelmed that patients who would be recovering if they were treated elsewhere in China are dying.

How deadly is COVID-19?

A study by China's Center for Disease Control and Prevention (China CDC) found that about 80% of COVID-19 cases were considered to be mild.

As noted above, the fatality rate is also far higher in Hubei (2-4% of cases) than in the rest of China (0.7%). At this time, there is a global 3.3% case-fatality rate for COVID-19.

While I don't underestimate the severity of the outbreak, at this point, COVID-19 appears to be far less deadly than the severe acute respiratory syndrome (SARS) coronavirus that appeared in 2002-03, and which had a case-fatality rate of about 10%. The COVID-19 case-fatality rate is subject to ongoing revision.

The Middle East respiratory syndrome (MERS), a coronavirus that was first identified in Saudi Arabia in 2012, had a case-fatality rate of about 35%.

Ebola virus disease (EVD) is rare, but has an average case fatality rate of about 50%.

Another way to look at it is that according to the U.S. Centers for Disease Control and Prevention (U.S. CDC), so far during the current influenza season, there have been at least 29 million flu illnesses, 280,000 hospitalizations and 16,000 deaths from flu in the U.S. Globally, COVID-19 has caused 2,618 deaths.

But, can we trust the virus numbers out of China?

I understand why the initial reaction by many is to be skeptical of all data published by the Chinese government. Especially in this case, where local officials clearly covered up the virus outbreak during its initial phase, contributing to its wider spread. But, since the government's official acknowledgement of the virus and the lockdown in Wuhan city on January 23, I have not seen compelling evidence of continued, deliberate efforts to hide the number of cases or deaths. In fact, after several senior officials in Hubei were sacked for covering up the initial outbreak, their successors probably have no incentive to under-report case numbers.

More importantly, fatality data from outside of China is consistent with the trends in the Chinese government numbers. The COVID-19 fatality rate in mainland China outside Hubei is 0.8%, and close to the 1.2% fatality rate in the world outside mainland China.

For SARS, we know that 55% of the global fatalities were outside of mainland China, and the fatality rate was higher (15%) outside of China compared to inside China (7%).

What about reports that COVID-19 was manufactured by the Chinese government?

This rumor has been circulating for some time, but I'm not aware of any credible scientist who has endorsed it. Many scientists have, in fact, explicitly rejected those rumors.

On February 19, The Lancet, one of the leading, peer-reviewed medical journals, published a letter signed by 27 prominent public health scientists from the U.S., Europe and Australia:

“We stand together to strongly condemn conspiracy theories suggesting that COVID-19 does not have a natural origin. Scientists from multiple countries have published and analysed genomes of the causative agent, severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), and they overwhelmingly conclude that this coronavirus originated in wildlife, as have so many other emerging pathogens. This is further supported by a letter from the presidents of the US National Academies of Science, Engineering, and Medicine and by the scientific communities they represent. Conspiracy theories do nothing but create fear, rumours, and prejudice that jeopardise our global collaboration in the fight against this virus.”

“There's absolutely nothing in the genome sequence of this virus that indicates the virus was engineered,” Richard Ebright, a professor of chemical biology at Rutgers University, told the Washington Post. “The possibility this was a deliberately released bioweapon can be firmly excluded.”

The New York Times wrote that “the conspiracy theory lacks evidence and has been dismissed by scientists.”

A team of international scientists led by the Department of Immunology and Microbiology at The Scripps Research Institute in California, reported that “genomic evidence does not support the idea that SARS-CoV-2 is a laboratory construct.”

“From everything I've looked at, there is zero evidence for genetic engineering; it looks like normal evolution,” said Trevor Bedford, a computational biologist at Fred Hutchinson Cancer Research Center in Seattle, who has been using genome sequences taken from patient samples to track the spread of the virus since Jan. 11. Speaking at a meeting of the American Association for the Advancement of Science on February 14, Bedford said, “Thousands of mutations are distributed across the genome. If you're engineering something, you wouldn't do that. There are no signals for biological engineering. It looks like natural evolution.”

What are the biggest risks to the apparent trend that the virus is coming under control in China?

In my view, the three biggest risks are likely to become clear in the coming few weeks. First, in China, excluding Hubei, people are slowly starting to resume normal lives. As increasing numbers of people gather on public transport, in offices, factories and restaurants, there is a risk that this closer human-to-human contact will result in a spike in new virus cases. We will be watching this carefully.

The second risk is that the recent acceleration in new cases reported outside of China leads to far more cases in Iran, South Korea and Italy, which could lead to the disease appearing in many more countries.

The third risk is that there have been some cases of individuals transmitting COVID-19 before they had symptoms of the virus. Scientists and public health officials are still trying to determine whether this is common or rare. If transmission by pre-symptomatic people is common, the disease will be significantly harder to control.

Will COVID-19 be declared a pandemic?

It is possible that public health officials will soon declare that COVID-19 is a pandemic. That isn't a good sign, but it's not as scary as it sounds.

In public heath terms, an “outbreak” is when there is a sudden increase in the number of people with a disease. That becomes an “epidemic” if the outbreak spreads over a larger geographical area. An example of an epidemic is the Zika virus, which started in Brazil in 2014 and spread to most of Latin America and the Caribbean.

A “pandemic” is a disease that has spread globally. But it is important to note that this term does not describe the severity of a disease, it only refers to its geographic spread.

The most recent pandemic was in 2009, when the H1N1 virus, sometimes called “swine flu,” circulated around the world. It is worth revisiting some of the details of that pandemic, to put the current COVID-19 situation into context.

H1N1 was first detected in California, on April 15, 2009. Fifteen days later, President Obama announced that, “Our public health officials have recommended that schools with confirmed or suspected cases of this flu strongly consider temporarily closing.” By May 5, 980 U.S. schools had closed, affecting over 600,000 students, and some schools remained closed through November.

On June 11, 2009, the World Health Organization (WHO) declared a pandemic, and that designation remained in place for about a year until August, 2010.

From April 12, 2009 to April 10, 2010, the U.S. CDC estimated that there were 60.8 million H1N1 cases, with 274,304 hospitalizations and 12,469 deaths in the U.S. Additionally, the U.S. CDC estimated that 151,700-575,400 people worldwide died from H1N1.

Returning to the current COVID-19 epidemic, as of February 23, there have been 2,618 global deaths, 95% of which have been in China's Hubei province. As of February 22, the U.S. CDC reported that “this virus is NOT currently spreading in the community in the United States. . . For the general American public, who are unlikely to be exposed to this virus, the immediate health risk from COVID-19 is considered low at this time.”

Will the COVID-19 outbreak threaten the Communist Party's rule?

Some foreign commentators have speculated that spread of the virus, especially the initial cover-up, will lead to a popular uprising against the Chinese Communist Party. This is, in my view, highly unlikely, both because the Party appears to be quite popular with the average Chinese citizen, and because there is no real alternative to the Party.

Princeton University professor Rory Truex, in a recent article in TheAtlantic.com, sets the stage for this discussion well:

“For a cottage industry of Western experts, the fall of the Chinese Communist Party is always just one crisis away. In 2008, it was the Wenchuan earthquake in Sichuan province that toppled shoddily constructed schools and killed 70,000 people. Later that year, 300,000 babies became sick from drinking milk made from formula tainted with melamine, which revealed the fragility of the country's food-safety system. In 2011, it was a collision of high-speed trains in Wenzhou that showed the problems with the country's pace of infrastructure development. Each of these catastrophes was going to be China's version of Chernobyl, the nuclear leak that revealed and accelerated the terminal decline of the Soviet Union, but that moment has never come.”

The Party continues to behave badly in many respects, especially in Xinjiang and Tibet, but the life of most Chinese people has improved steadily, both in terms of material living standards and personal freedom.

When I first worked in China, in 1984, there were no private companies— everyone worked for the state. You couldn't even find a privately run restaurant. Today, 87% of urban employment is in small, privately owned, entrepreneurial firms.

Income growth has been phenomenal, largely due to the rise of private enterprise. Real (inflation-adjusted) income rose 113% over the last decade, compared to a 21% increase in the U.S.

This rise of entrepreneurs—the engine of China's economy—and the substantial improvement in material living standards has been accompanied by an equally impressive expansion in personal freedom. The absence of political rights and the rule of law are important long-term problems. And there are serious abuses in places like Tibet and Xinjiang, but most Chinese people have the freedom to run their own lives to a degree that was unimaginable just 40 years ago. Back then, the Party controlled every aspect of every person's life: where to live; where to go to school and what to study; the Party assigned you a job with the state; they could veto your choice of spouse; they controlled internal travel and permitted few to leave the country; and they controlled all forms of communication. None of that is the case today. And, in my view, continued expansion of personal freedom and wealth creation will inevitably lead to more political rights.

All of these factors, as well as the absence of any real alternatives to the Party (because the Party has prevented organized opposition), means that although many Chinese citizens may be dissatisfied with how their leaders handled the virus outbreak, they are unlikely to advocate regime change.

What will be the economic impact of the virus?

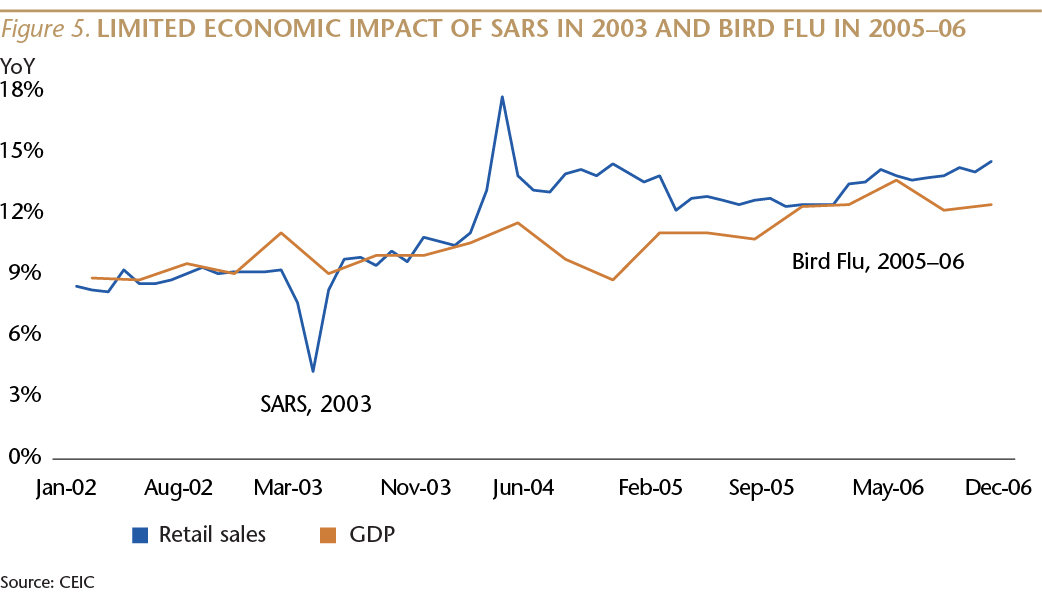

To get a sense of how the Chinese economy might respond to COVID-19, we've looked back at the impact of the 2002-03 SARS outbreak and the 2005-06 bird flu epidemic. Our main conclusion is that after a sharp, short-term negative impact, the Chinese economy rebounded quickly. There was also little impact on the Shanghai stock market.

As a result of SARS, the growth rate of nominal retail sales slowed from 9.2% YoY in the first quarter of 2003 to 4.3% in May, but rebounded to 8.3% in June and 9.8% in July and 9.9% in August. For the full year 2003, nominal retail sales rose 9.1%, up a bit from 8.8% in 2002.

GDP growth slowed from 11.1% YoY in the first quarter of 2003 to 9.1% in the second quarter, but rebounded to 10% in the third quarter. For the full year, GDP rose by 10%, compared to 9.1% in 2002.

Past performance, of course, is no guarantee of future results, but this historical data does give me confidence that if COVID-19 is largely brought under control in March, then economic activity can return to normal in China (excluding Hubei) before the damage becomes severe. (I do want to reiterate my earlier caution that knowledge of this new disease is incomplete and evolving daily, and if any of the three risks described earlier in this note come to pass, the economic impact inside and outside of China would be greater.)

There is one big difference between China's economic structure during the time of SARS and today: the role of small, privately owned companies. Today, these entrepreneurial firms account for 84% of the total number of business entities, versus 61% in 2004. This is important because small, private firms are relatively fragile: they generally do not have large cash reserves or lines of credit to tide them over for a lengthy period of virus-related closure.

This is where government support will be critical, once public health conditions allow firms to reopen. At this point, Beijing has acknowledged this issue and has talked about supporting private firms, with measures such as temporarily reducing mandatory monthly payments for health insurance, as well as contributions for social security, unemployment and housing provident benefits. If implemented quickly and efficiently, steps like these could help many small firms survive a couple of months of inactivity.

Another important step would be for China's banks to provide small, short-term credit lines to small private companies that just need bridge loans until business gets back to normal. This would help firms make payroll, which would support consumer spending.

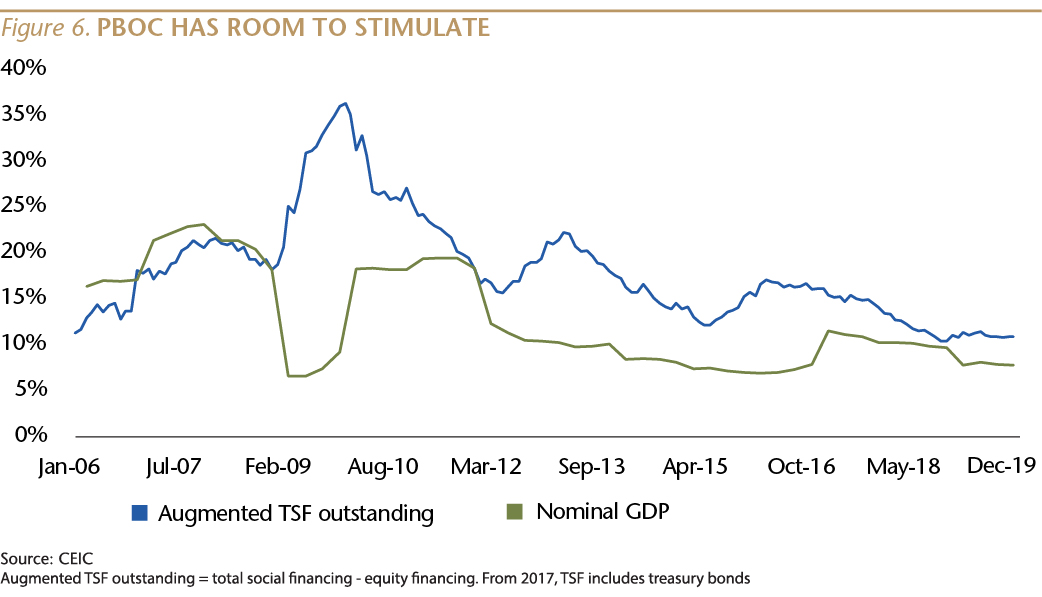

Beijing could do this without a massive credit stimulus, and given that the growth rate of augmented aggregate credit outstanding (Total Social Finance) was 10.9% YoY in January, compared to 11% a year ago, the central bank has plenty of room for a modest stimulus.

But the firms that are most at risk probably do not have existing relationships with banks, which will make branch managers nervous about granting new loans. On the other hand, in a system where the Communist Party controls the banks and is capable of mass mobilization, quick dispersal of micro-scale loans to small firms is certainly feasible, and even if the default rates turn out to be high, the amounts will be relatively low.

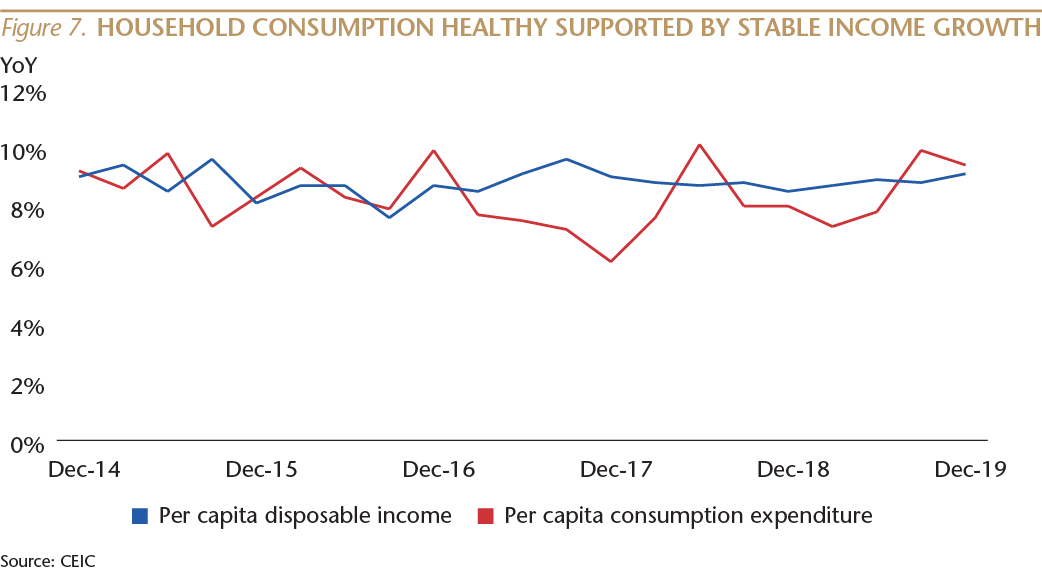

It is also worth noting that the Chinese economy was in good health before the coronavirus arrived. Last year was the eighth consecutive year in which the consumer and services (tertiary) part of GDP was the largest part, and consumption accounted for 58% of GDP growth. Strong income growth continued to fuel the consumer story. Nominal per capita disposable income rose 9.1% in the fourth quarter, up from 8.5% a year earlier and 9% two years ago.

Household consumption spending rose 9.4% YoY in 4Q19, compared to 8.0% a year earlier and 6.1% two years ago.

My base case is that economic activity begins to return to normal by late March, and that while first quarter macro and earnings numbers will be terrible, the full year growth rates are likely to be reasonable.

Regards,

Andy Rothman

Investment Strategist

Matthews Asia

Back to Thought Leadership